Benefits of Developing an ESRM System

- States a financial institution’s commitment to environmental and social management.

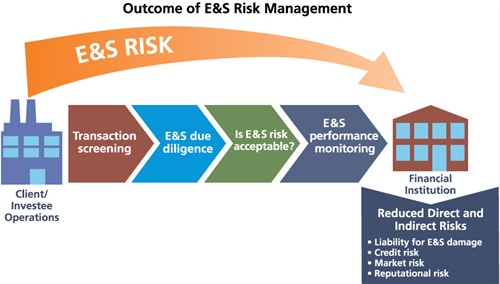

- Explains its procedures for identifying, assessing, and managing the environmental and social risks of financial transactions.

- Describes the roles, responsibilities, and capacity needs of staff for doing so and states the documentation and recordkeeping requirements.

- Provides guidance on how to screen transactions, categorize transactions based on their environmental and social risk, conduct environmental and social due diligence and monitor the client’s/investee’s environmental and social performance.

The supporting policies and procedures of the ESRM System should be well documented, made available to all staff with responsibilities for implementation, and can be compiled into a stand-alone operations manual to formally document the process. This manual should be updated regularly through a simple but effective revision process.

As the procedures and decision-making processes of the ESRM System are systematically incorporated at each stage of transaction appraisal and monitoring, the ESRM System cannot function as a stand-alone system. The process for developing an ESRM System needs to consider a financial institution’s existing risk management framework and transaction cycle.

Our Services

Contact us

FILL FORM AND OUR TEAM WILL CONTACT YOU