PRI is the world’s leading advocate for responsible investment. In 2006, the PRI was launched at the New York Stock Exchange and had 100 investors, since then it now has over 3000 investors, representing over $100 Trillion worth of investments.

Its purpose is to identify the investment implications of environmental, social, and governance (ESG) factors and to support its international network of signatory investors in incorporating these factors into their investment and ownership decisions. It encourages investors to use responsible investment to enhance returns and better manage risks but does not operate for its own profit; it engages with global policymakers but is not associated with any government; it is supported by, but not part of, the United Nations.

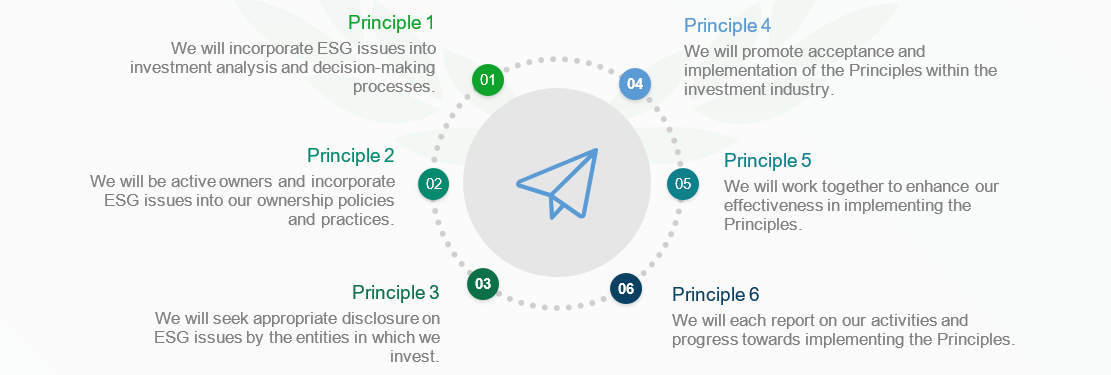

The 6 Principles for Responsible Investment are a voluntary and aspirational set of investment principles that offer a list of possible actions for incorporating ESG issues into investment practice. These were developed by investors, for investors. In implementing them, signatories contribute to developing a more sustainable global financial system.

The 6 Principles

Our Services

Benefits of Adopting the Principles for Responsible Investment

INTERNAL BENEFITS FOR FINANCIAL INSTITUTIONS

- Incorporate ESG issues into your organisation’s policies, investment analysis, and decision-making processes.

- Boost your organisation’s E&S risk management system

- Enhance your organisation’s sustainable lending and investing

EXTERNAL BENEFITS FOR FINANCIAL INSTITUTIONS

- Disclose how ESG issues are integrated within your investment practices

- Promote sustainable investing in the financial sector

- Meet compliance requirements of CBE, FRA, investors, and international financial institutions

- Invitations to over 100 events and workshops each year, including PRI in Person

- Resources for reporting and assessing your organization’s ESG activities

- Access to other signatories’ reports and assessments through the PRI Data Portal

- Support from a regional relationship manager with the local market knowledge

- Use of the Collaboration Platform to network with signatories and engage with ESG research

- Guidance on how to incorporate ESG factors into investment decision-making and ownership

Contact us

FILL FORM AND OUR TEAM WILL CONTACT YOU